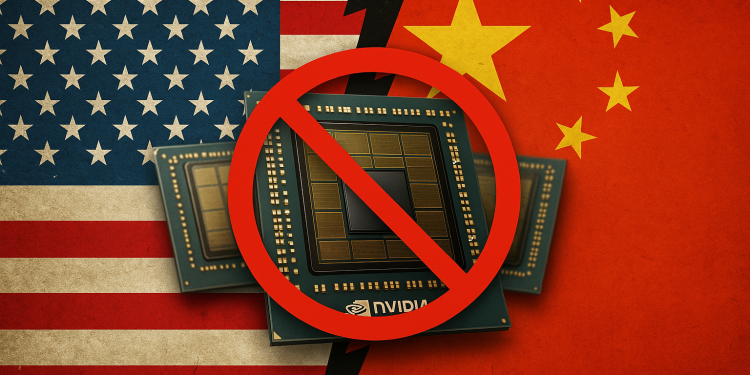

In a move that underscores Washington’s escalating tech rivalry with Beijing, US President Donald Trump announced that Nvidia’s most advanced Blackwell AI chips will be restricted to American buyers.

The decision, revealed during a CBS ’60 Minutes’ interview and confirmed to reporters aboard Air Force One, marks one of the sharpest export curbs yet on artificial intelligence hardware.

It signals that the United States intends to keep its most powerful AI processors out of foreign hands, including China, to maintain its technological dominance.

US to keep Blackwell chips for domestic firms

Trump said the most advanced Nvidia Blackwell chips would not be sold to other countries, telling CBS that,

The most advanced, we will not let anybody have them other than the United States.

He repeated that message while returning from Florida, stating that the government would not “give the Blackwell chip to other people.”

The comments suggest tighter restrictions than US officials had previously indicated, expanding the country’s export control regime.

The policy means Nvidia, the world’s most valuable chipmaker by market capitalisation, will reserve its most powerful AI processors for US-based customers.

The decision follows months of debate in Washington about whether to permit even scaled-down versions of the chips for foreign markets.

Nvidia had announced that more than 260,000 Blackwell chips would be supplied to South Korea, including to Samsung Electronics, but Trump’s remarks indicate that future shipments of the most sophisticated models could be confined to US companies.

China faces deepening technology restrictions

Beijing’s access to high-performance AI chips has already been limited by earlier US export controls, but the new restriction closes the door on the latest generation of Nvidia’s hardware.

The Blackwell chips, designed to handle complex machine learning and generative AI workloads, represent a critical tool for building advanced AI models.

Trump said that while Chinese companies may still “deal with Nvidia,” they would not be allowed to buy the most advanced chips.

This leaves possibility of exporting lower-spec versions open, but experts warn that even such sales could reduce the US lead in AI computing power.

Republican Congressman John Moolenaar, who chairs the House Select Committee on China, said allowing any version of the chip to reach Chinese firms “would be akin to giving Iran weapons-grade uranium.”

The remarks highlight growing bipartisan pressure in Washington to block advanced semiconductor sales to China on national security grounds.

Experts say the latest move will push China to accelerate efforts to develop domestic alternatives.

With Nvidia and other US chipmakers restricted, Chinese companies like Huawei and Biren Technology are expected to expand production of homegrown AI processors to close the performance gap.

Shift in AI strategy and market implications

The restriction also represents a reversal from the Trump administration’s July artificial intelligence blueprint, which aimed to loosen environmental rules and promote AI exports to allied countries.

The new policy underscores a shift from expansion to containment, prioritising security and control over global market access.

Nvidia Chief Executive Jensen Huang recently confirmed that the company has not applied for US export licences for China, citing both regulatory complexity and China’s current stance toward the firm.

He said Beijing has made it clear that Nvidia is “not wanted there right now,” while also acknowledging that global sales are essential to funding its US-based research and development.

Industry observers note that the new restrictions will deepen fragmentation in the global semiconductor market.

US allies may still access Blackwell chips under approved export conditions, but China’s exclusion is expected to reshape supply chains and accelerate regional self-sufficiency efforts.

What comes next

The Commerce Department is expected to define the technical criteria that separate “advanced” chips from downgraded versions that might still be exportable.

These classifications could determine which global partners remain eligible for limited access to Nvidia’s products.

For the US, the restriction reinforces its position as the dominant force in AI hardware development. For China, it adds pressure to achieve chip independence faster.

Experts say the decision marks a turning point in the global AI race, where access to high-performance computing resources will increasingly define a nation’s competitive strength.

By keeping Nvidia’s most powerful AI chips confined to domestic use, Washington has drawn a clear boundary in the semiconductor landscape, widening the technological gap between the world’s two largest economies.

The post US to bar China, other countries from buying Nvidia’s advanced Blackwell AI chips appeared first on Invezz