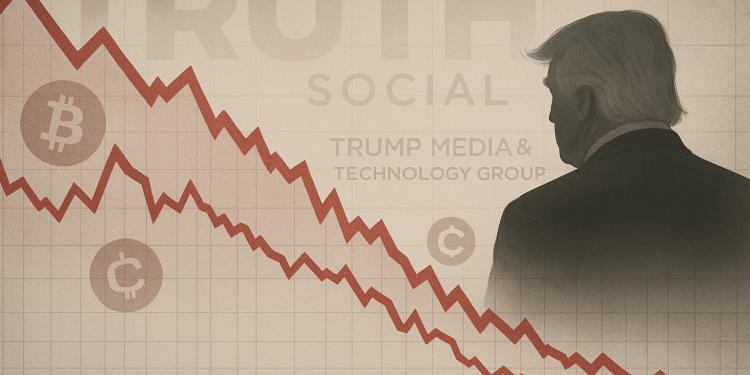

Less than a year into Donald Trump’s second term, the optimism that once surrounded Trump Media & Technology Group (TMTG) has sharply faded.

The company behind Truth Social reported another steep quarterly loss as revenue declined and expenses climbed, underscoring its struggle to turn political visibility into financial stability.

The firm posted a net loss of $54.8 million for the three months ended Sept. 30, more than double the $19.2 million loss recorded a year earlier.

Revenue fell 3.8% year-over-year to $972,900, reflecting stagnating growth in its core social media operations.

Shares of Trump Media (NASDAQ: DJT) fell as much as 4.7% to $12.70 on Friday, extending their slide after hitting the lowest close since September 2024.

The stock is now down roughly 70% from its January peak of $42.91.

Persistent losses despite new ventures

Trump Media has yet to report a profit since going public in March 2024 via a merger with a special-purpose acquisition company (SPAC).

Despite the firm’s efforts to diversify its operations, from exchange-traded funds (ETFs) to prediction market contracts, total sales remain below $1 million per quarter.

The company said its total assets stood at $3.1 billion, a figure that includes both cash holdings and about $1.5 billion in digital assets, primarily composed of $1.3 billion in Bitcoin and $147 million in Cronos (CRO).

While the digital holdings give Trump Media exposure to the cryptocurrency sector, the recent downturn in crypto markets could weigh on its future earnings.

The company also faced a sharp rise in costs, including $20.3 million in legal expenses during the quarter.

These costs contributed significantly to the widening losses and highlighted the firm’s ongoing operational and regulatory challenges.

Revenue pressures and limited user transparency

Trump Media’s primary source of revenue comes from advertising on Truth Social, the social network often used by President Trump as his main communications platform.

However, monetizing the platform’s political visibility has proven difficult.

Analysts and investors have expressed concerns about the company’s limited disclosure practices.

Unlike most major social media firms, Trump Media does not regularly report user metrics such as daily or monthly active users, making it difficult to gauge audience growth or engagement trends.

CEO Devin Nunes, a former Republican congressman, has emphasized efforts to build out the company’s digital ecosystem and expand revenue streams.

Still, for now, Truth Social remains heavily reliant on Trump’s own activity and the platform’s ability to maintain relevance among his political base.

Volatility and investor uncertainty

Since its public debut, Trump Media’s stock has been one of the most volatile listings on the Nasdaq, often moving sharply on political developments or social media sentiment rather than fundamental performance.

Retail investors have remained a key part of the shareholder base, but sustained losses and limited revenue growth have dampened the enthusiasm that initially drove the stock higher after its market debut.

Despite attempts to pivot into new ventures, including a partnership with Crypto.com announced in August to accumulate CRO tokens, Trump Media’s financial position remains challenging.

The company continues to face the dual task of managing high costs while trying to convert its political visibility into sustainable revenue.

For now, TMTG’s future hinges on its ability to expand monetization, control expenses, and navigate the unpredictable intersection of politics, social media, and cryptocurrency.

The post Trump Media slump after reporting wider quarterly loss as sales decline appeared first on Invezz