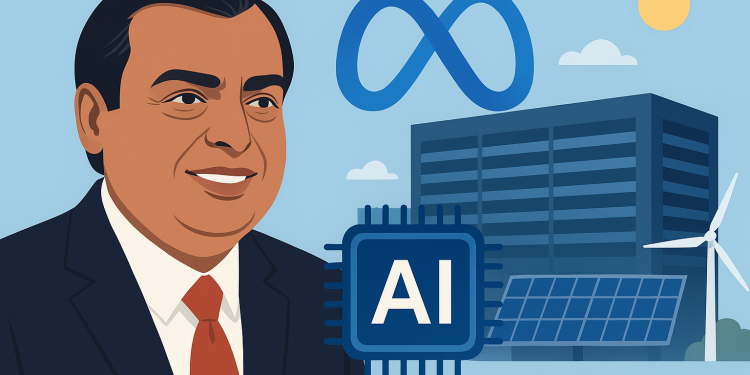

Shares of Reliance Industries Ltd (RIL) rose more than 2% on October 27 after it was revealed that Meta Platforms Inc.’s Facebook Overseas will hold a 30% stake in Mukesh Ambani-led RIL’s artificial intelligence venture.

The announcement marks a significant collaboration between India’s largest conglomerate and one of Silicon Valley’s biggest technology firms.

According to the company’s exchange filing, Reliance Intelligence, a unit of RIL, has invested ₹2 crore as the initial subscription for 2 million equity shares of ₹10 each in its subsidiary, Reliance Intelligence Enterprises Ltd (REIL).

The entity will later become the joint venture vehicle with Facebook Overseas under an amended agreement.

Both companies have committed a total initial investment of ₹855 crore (approximately $100 million), with Reliance Intelligence holding a 70% stake and Facebook Overseas owning the remaining 30%.

Partnership to power India’s AI-driven digital growth

Brokerage firm Investec described the collaboration as a “major step in India’s AI-driven digital growth.”

The joint venture combines Reliance’s vast digital and infrastructure assets with Meta’s expertise in artificial intelligence, aiming to deliver affordable, secure, and scalable AI services in India.

“This is a strategic collaboration that positions India at the forefront of applied AI,” Investec noted, adding that the companies’ complementary strengths could create a powerful ecosystem for AI development and deployment.

The announcement also reinforces Reliance’s broader ambition to transform itself from an energy giant into a diversified technology and digital powerhouse.

How Reliance’s AI business could be valued at around $30 bn by 2027

Morgan Stanley analysts estimate that Reliance could deploy between $12 billion and $15 billion toward building AI infrastructure, including a 1-gigawatt data center — one of the largest in Asia.

About 25% of the capacity will be underwritten by Reliance itself, with the remaining expected to be leased out as “Datacenter as a Service” to hyperscalers and AI model providers.

“We estimate an ROCE of approximately 11% on these initial investments, based on recent token prices from LLM providers,” said Mayank Maheshwari at Morgan Stanley.

The firm projects annual revenues of $1.5–1.6 million per megawatt for Reliance’s data center services.

According to Morgan Stanley, the valuation case for the AI vertical is compelling.

“We believe it could be valued at a minimum of 2x P/B, if not higher, considering the valuations of global peers such as GDS in Asia (US players like CoreWeave and Equinix trading at even richer multiples),” Morgan Stanley noted.

On this basis, experts project that Reliance’s AI business could be valued at around $30 billion by 2027.

Integrating AI with clean energy and telecom expansion

Reliance’s strategy rests on two interconnected tracks: expanding its AI data center capacity and leveraging its clean energy ecosystem to power these facilities sustainably.

The company plans to use its initial 100-megawatt generative AI data center capacity to serve enterprise demand while scaling toward 1 gigawatt over two years through the Meta partnership and alliances with Google and Microsoft Azure.

At the same time, Reliance is positioning its renewable energy division as a key supplier to its AI operations.

Morgan Stanley estimates that RIL will underwrite over 20 gigawatts of internal power demand to support 100 gigawatts of solar panel capacity and 30–40 gigawatt-hours of battery storage — turning the data center energy requirement into a captive market for its green energy vertical.

Market confidence and valuation outlook

The market response has been positive, with RIL shares rising after the announcement.

Data compiled by LSEG shows that 34 analysts currently rate Reliance as a “buy,” with a median price target of ₹1,680.

Whether Reliance’s AI venture achieves a $30 billion valuation will depend on execution and how successfully it captures India’s emerging AI infrastructure opportunity.

For now, investors appear optimistic that the company’s combination of deep capital access, energy infrastructure, and digital reach will help it establish a dominant position in the country’s AI ecosystem.

The post Reliance-Meta AI JV: what it means for India’s AI play and conglomerate’s future appeared first on Invezz